The Power of

a Deposit

Institutional Investors

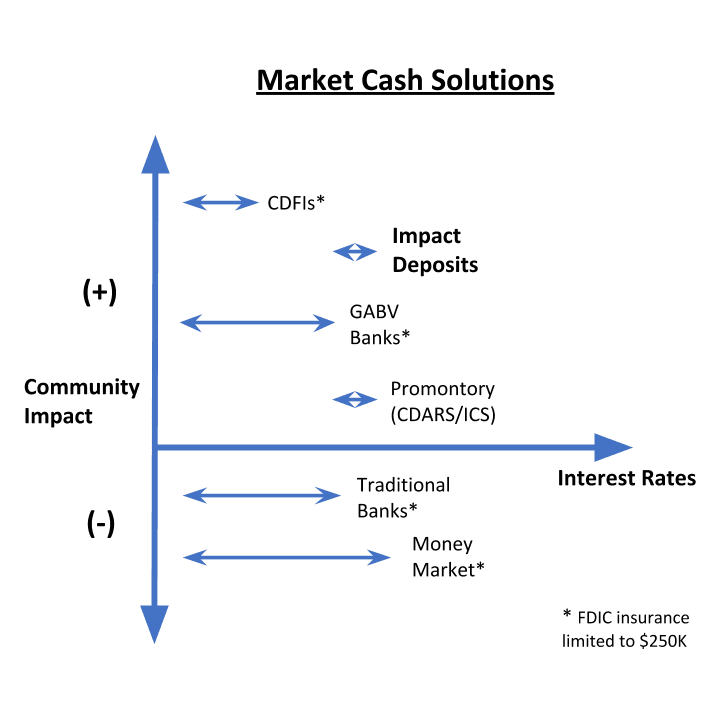

Total deposits at U.S. banks are at an all-time high of $14 trillion with over $5 trillion in money market accounts and $3 trillion in savings accounts. Institutional investors such as pension funds, investment companies, and insurance companies manage a significant portion of this cash that sits idle, often for years, delivering limited benefit for our communities. As responsible institutional asset owners and managers evaluate their portfolios for ESG considerations and look to unlock capital for impact, our program addresses this blind spot for institutional cash.

Rather than leave cash unsecured in traditional banks (with track records like Wells Fargo) or money market funds that pay lower returns, Impact Deposits Corp., a proud signatory of the United Nations PRI, extends FDIC-insurance on large cash deposits, and offers the optimal solution in the market for maximizing both impact and interest rates.

Municipalities & Local Governments

Our program is particularly valuable for funds coming from cities, municipalities, counties, townships and school districts. This is because public funds have legal requirements for the security of their assets that conventional investment accounts are unable to meet, and their constituents want their tax dollars to support their local community.

Rather than chase returns with riskier corporate paper, comparable financial returns can be achieved through our impact deposit program, and the deposits are put to work in the community.

Learn more about how the program is customized to serve regional interests.

the Individual

According to a survey conducted for Capgemini and RBC Wealth Management, a full 92% of high net worth individuals (HNWI) think driving social impact is important.

Furthermore, 75% of HNWIs 40 and under believe it to be “very” or “extremely” important, including those in emerging markets.

TOP 5 WAYS HNWIs

seek to make a social impact

The simple decision to partner with Impact Deposits for large cash on deposits management and security will also support four of these top five ways to make a social impact.

Now that is a creative, and smart way to make a difference!

the Family Office

According to the UBS/Camden Wealth Global Family Report 2019, five years from now, over a third (37%) of family offices expect to increase their total impact allocation to between 10% and 24% of their portfolios, while just under a third (30%) plan to allocate 25% or more. The average across all participants is anticipated to be 25%.

the Family Office

According to the UBS/Camden Wealth Global Family Report 2019, five years from now, over a third (37%) of family offices expect to increase their total impact allocation to between 10% and 24% of their portfolios, while just under a third (30%) plan to allocate 25% or more. The average across all participants is anticipated to be 25%.

IMPACT INVESTMENT – ASSET CLASSES

% of Family Offices

- Direct Private Investments 76%

- Real Estate (e.g., green buildings, affordable housing) 32%

- Private Equity Funds 24%

- Infrastructure (e.g., renewable energy, public transportation) 18%

- Direct private debt 15%

- Public Equity 13%

- Private debt funds 10%

- Cash & cash equivalents 6.5%

- Public Debt 0%

Source: The UBS/Campden Wealth Global Family Office Report 2019

IMPACT INVESTMENT – SECTORS

% of Family Offices

- Education 45%

- Agriculture and food 45%

- Energy and resource efficiency 43%

- Health care and wellness 38%

- Environmental conservation 34%

- Housing and community development 34%

- Sustainable consumer products 29%

- Job creation 26%

- Women’s empowerment 26%

- Access to finance 22%

- Sustainable infrastructure 22%

- Infrastructure 11%

Source: The UBS/Campden Wealth Global Family Office Report 2019

Impact Deposits

Can Drive All Sectors

We partner with leading family offices committed to leveraging cash to drive social good. Cash on deposit is now as powerful a part of the social impact portfolio as it is secure!

Foundations, Nonprofits & Endowments

Of the more than 80,000 registered foundations in the United States, according to the I.R.S., two-thirds have endowments less than $1 million dollars (the median is $500,000).

According to Foundations Source, private foundations with endowments less than $50 million make up 98% of these 80,000 private U.S. foundations.

Equally impactful and even more impressive, a survey of 732 of these foundations indicated they gave well in excess of the federally mandated 5% payout requirements, averaging a staggering 11.6%.

Impact Deposits is a trusted and secure resource for foundations, charities and endowments to utilize in the management, security and liquidity of funds to be distributed. Impact Deposits supports causes aligned with the missions of these philanthropic organizations.

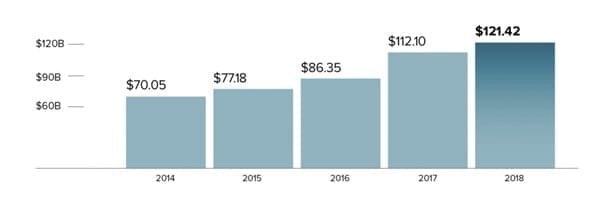

Donor Advised Fund Sponsors

DAF sponsors are collecting billions of dollars in funds, but with payout rates hovering around 20%, the bulk of capital remains in the sponsors’ funds. For the cash portions of those funds, instead of putting them in a money market fund or some equivalent:

- Deposit the fund’s cash with an organization that is mission-aligned

- Allow the cash to support the causes tied to your organization

- Better engage local banks to participate in supporting those causes

- Generate better returns for your fund both financially and socially

Learn more about social impact cash deposit options in the marketplace.

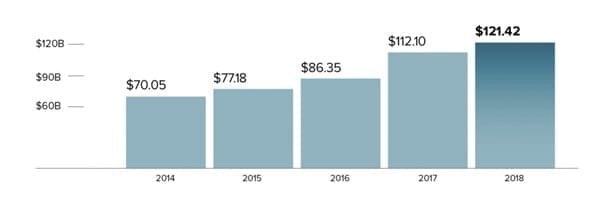

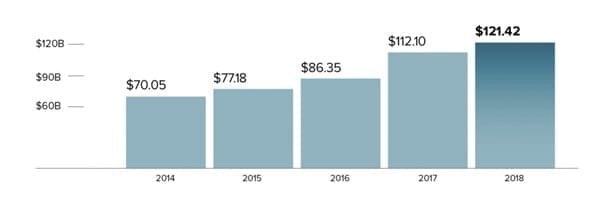

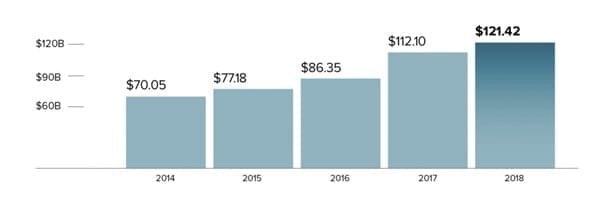

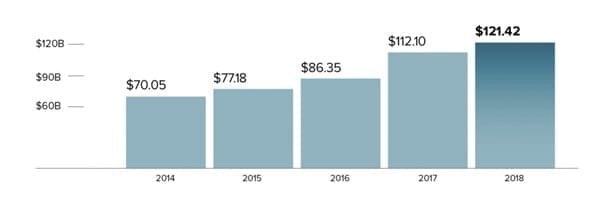

Total Assets in Donor-Advised Funds ($B)

Source: 2019 Donor-Advised Fund Report, National Philanthropic Trust.

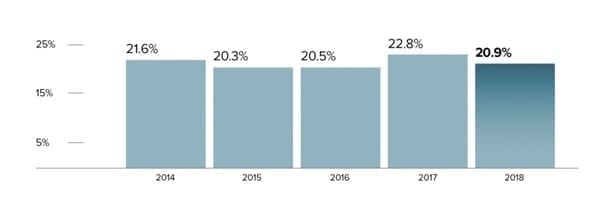

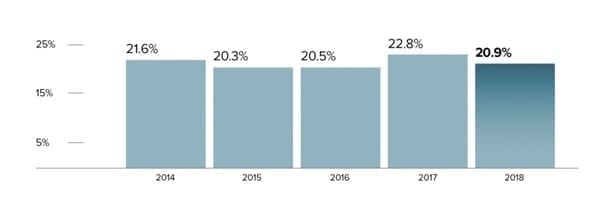

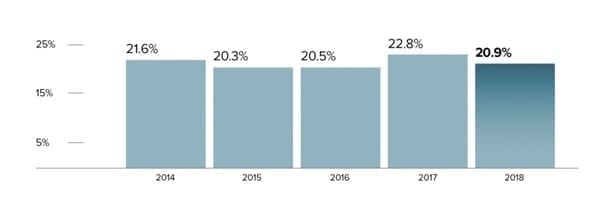

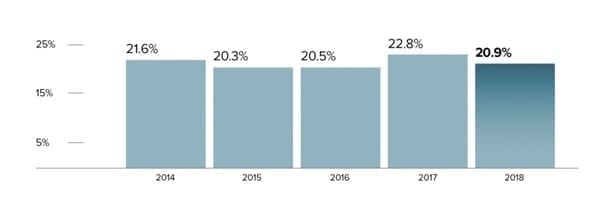

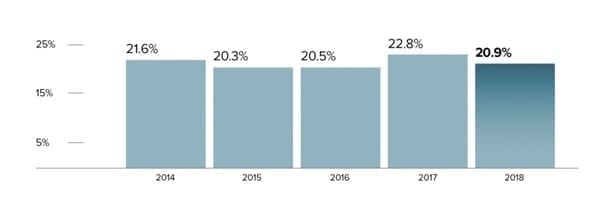

Annual Payout Rate, Total for all Donor-Advised Funds

Source: 2019 Donor-Advised Fund Report, National Philanthropic Trust.

Donor Advised Fund Sponsors

DAF sponsors are collecting billions of dollars in funds, but with payout rates hovering around 20%, the bulk of capital remains in the sponsors’ funds. For the cash portions of those funds, instead of putting them in a money market fund or some equivalent:

- Deposit the fund’s cash with an organization that is mission-aligned

- Allow the cash to support the causes tied to your organization

- Better engage local banks to participate in supporting those causes

- Generate better returns for your fund both financially and socially

Learn more about social impact cash deposit options in the marketplace.

Total Assets in Donor-Advised Funds ($B)

Source: 2019 Donor-Advised Fund Report, National Philanthropic Trust.

Annual Payout Rate, Total for all Donor-Advised Funds

Source: 2019 Donor-Advised Fund Report, National Philanthropic Trust.

Corporations

- Support the causes publicly championed by the company

- Leverage an underutilized asset (cash) to achieve local good

- Align corporate treasuries with company messaging to stakeholders

- Generate better returns for your company both financially and socially

Banks, CDFIs, & MDIs

Unlike the traditional program depositors referenced above, banks, CDFIs, and minority depository institutions (MDIs) are often partners of Impact Deposits, seeking cash deposit management solutions that not only keep their customers’ deposits (over $250,000) fully FDIC insured but also better align with the stated causes of the bank. Even for those community banks that are not CDFIs or MDIs, banks are constantly striving to strengthen their corporate image with stakeholders, and being a partner of Impact Deposits allows banks to:

- Highlight the social good that customers’ deposits with the bank can achieve

- Better support the causes publicly championed by the bank

- Improve Community Reinvestment Act performance

- Generate better returns for the bank both financially and socially

Banks & CDFIs

Unlike the traditional program depositors referenced above, banks and CDFIs are often partners of Impact Deposits, seeking cash deposit management solutions that not only keep their customers’ deposits (over $250,000) fully FDIC insured but also better align with the stated causes of the bank. Even for those community banks that are not CDFIs, banks are constantly striving to strengthen their corporate image with stakeholders, and being a partner of Impact Deposits allows banks to:

- Highlight the social good that customers’ deposits with the bank can achieve

- Better support the causes publicly championed by the bank

- Improve Community Reinvestment Act performance

- Generate better returns for the bank both financially and socially