About Us

We make connections that drive positive change through the power of cash deposits.

Impact Deposits Corp. is a purpose-driven company that proactively builds mutually-beneficial relationships between community banks, nonprofits, and partners to accelerate positive economic and social outcomes.

Through the operation of our U.S. cash deposits management network, Impact Deposits activates the power of portfolio cash on deposits. This network of community banks with accounts structured to generate benefits to local nonprofits and partners, support positive economic and social outcomes. Through these structures, Impact Deposits supports more than 400 nonprofits that receive direct, proactive assistance from Impact Deposits and its affiliates.

Since 2003, Impact Deposits has securely managed billions of dollars of large cash deposits across hundreds of participating community banks and donated over $13 million to local charitable organizations. Currently, almost 200 banks are active in our cash management network, all committed to providing community investment loans and fostering community partnership development.

watch a short introductory video

Through the operation of its U.S. cash deposits management network, Impact Deposits activates the power of portfolio cash on deposits. This network of community banks with accounts structured to generate benefits to local nonprofits and partners, support positive economic and social outcomes. Through these structures, Impact Deposits supports more than 400 nonprofits that receive direct, proactive assistance from Impact Deposits and its affiliates.

Since 2003, Impact Deposits has securely managed billions of dollars of large cash deposits across hundreds of participating community banks and donated nearly $13 million to local charitable organizations. Currently, almost 200 banks are active in our cash management network, all committed to providing community investment loans and fostering community partnership development.

watch a short introductory video

IN SUMMARY…

Impact Deposits securely and efficiently manages large cash deposits, in the process generating social benefits for communities and causes.

- Impact Deposits is a member of the Forum for Sustainable and Responsible Investment (US SIF) and a signatory to the United Nations-supported Principles for Responsible Investment (PRI).

- Impact Deposits donates over 60% of its revenue to nonprofits and organizations supporting social enterprises.

- Impact Deposits and its affiliates dedicate not only funds but also their time and resources to the charitable organizations they serve.

Impact Deposits - Articles of Incorporation

“The sole primary purpose of the Corporation is to develop and deliver programs that improve economic and social outcomes for people in the communities we live and work in especially through programs that link community banks with charitable organizations in the communities which they serve…”

IN SUMMARY…

Impact Deposits securely and efficiently manages large cash deposits, in the process generating social benefits for communities and causes.

- Impact Deposits is a member of the Forum for Sustainable and Responsible Investment (US SIF) and a signatory to the United Nations-supported Principles for Responsible Investment (PRI).

- Impact Deposits donates over 60% of its revenue to nonprofits and organizations supporting social enterprises.

- Impact Deposits and its affiliates dedicate not only funds but also their time and resources to the charitable organizations they serve.

Impact Deposits - Articles of Incorporation

“The sole primary purpose of the Corporation is to develop and deliver programs that improve economic and social outcomes for people in the communities we live and work in especially through programs that link community banks with charitable organizations in the communities which they serve…”

COMPANY HISTORY

Impact Deposits Corp. was founded May 1, 2000, with headquarters in Miami, Florida

The company name was updated in 2020 to reflect our historic and ongoing focus on social capital creation. Impact Deposits has developed an affiliate network to increase the scale of impact of the organization through additional deposits and participation of community banks and nonprofits.

Today, Impact Deposits manages billions of dollars across a network of hundreds of FDIC-insured banks and financial institutions on behalf of partner banks, high net worth individuals, foundations, and institutions. The company currently manages more than $2.5 billion in its cash deposit management network.

The company name and corporate form was updated in 2020 to reflect our historic and ongoing focus on social capital creation. Impact Deposits has developed an affiliate network to increase the scale of impact of the organization through additional deposits and participation of community banks and nonprofits.

Today, Impact Deposits manages billions of dollars across a network of hundreds of FDIC-insured banks and financial institutions on behalf of partner banks, high net worth individuals, foundations, and institutions. The company currently manages more than $2.5 billion in its cash deposit management network.

LEADERSHIP TEAM

President & CEO

William R. Burdette

Read Bio

William Burdette is President of Charity Services Centers, P.A. (CSC), and CEO of Impact Deposits Corp. Bill offers over 30 years of corporate finance and investment banking experience and previously owned and managed a regional broker-dealer firm. As the founder of CSC and Impact Deposits, Bill has been instrumental in product development, patent processing, legal structuring, computer automation, and government authorization. Bill developed the “charity affinity program”, the signature program of CSC, which links community banks with local charitable organizations. CSC now serves over 200 nonprofits and has four regional offices and eight satellite locations around the country. Bill also sits on the Board of Directors of Learning 1 to 1 Foundation. Bill received a bachelor’s degree from Northwestern University, Evanston, Illinois (B.A., 1969), a law degree from Columbia Law School, and an MBA from the University of Miami.

Senior Advisor

Alexandra Esher

Read Bio

Alex has over 25 years of financial management experience, including Vice President and Business Manager of a telecommunications company. Alex is President of Impact Deposits Corp. and has been with the company since 2005. She has been instrumental in catalyzing Impact Deposits’ growth through financial management and operational and administrative oversight. Alex is also the Vice President of Charity Services Centers, P.A. and responsible for managing bank relations and facilitating meaningful connections between banks and nonprofits. She advises many nonprofits on their programs and enjoys being a resource for them.

Chief Technical Officer

Gaspar Ferreiro

Read Bio

Gaspar Ferreiro is one of the founding members of Impact Deposits, where he wears many hats from helping to create the initial logic behind the aggregation software to monitoring the activity of the current platform. His background in technology has caused him to also be heavily involved in non-profit work, education, and social entrepreneurship. He is at the forefront of new technologies and how they relate to both banking and social entrepreneurship. This has naturally driven him to software development with a focus on Virtual and Augmented Realities. His work has been globally recognized and has been featured in RoadtoVr, UploadVR, VRFocus, VRRoom.buzz. Gasper attended Florida International University.

Accounting Manager

Michelle Frometa

Read Bio

Michelle has been with Impact Deposits since 2015. After building her accounting and clerical skills in the insurance field, she joined Impact Deposits as an assistant, and then quickly stepped into the Accounting Manager role after earning her BA from Florida International University.

Michelle has dedicated herself to perfecting Impact Deposits’ accounting systems, improving both output and departmental efficiency. Driven by the need for a challenge and the desire to make a future for herself and her family, Michelle purchased a delivery business in 2019 with a partner. Michelle’s greatest hope is that everywhere she goes, she can both grow and help in the growth of others.

System Architect

Samuel Segui

Read Bio

Sam is the architect of the core system that manages the depositors and banks in the deposit network. He has been associated with Impact Deposits for almost 15 years. The skills he brings to the company are not just associated with building and maintaining the system. He is extremely knowledgeable about the bank rates, P&L of Impact Deposits, and back office processing that helped Impact Deposits grow from $400 million to $1.8 billion. The social benefits that Impact Deposits is able to provide are in line with Sam’s passion of working with local non-profits in Puerto Rico.

Vice President, NE Region

Jay Stillman

Read Bio

Jay has over 15 years of experience in developing financial service companies’ sales and marketing efforts. He has worked with various types of banks, investment companies, and third-party deliverers of investment products. Recently he has been helping banks grow their community-based relationships to solidify their core business model. This includes working with non-profits and investors to grow new and existing accounts. Jay graduated from Pace University with a Bachelor of Business Administration degree in Management.

VP, Relationship Manager

Rosy Lopez

Read Bio

As Vice-President, Relationship Manager, Rosy Lopez plays a central role in Impact Deposits Corp.’s purpose driven mission. By partnering banks with non-profit organizations in communities they serve, she helps building the mutually-beneficial relationships that insure your cash deposits will have a positive social impact.

Rosy began her career in finance with commercial banking, where she spent 26 years working for a few of the country’s largest financial institutions. In 2018, she was offered an opportunity to make an impact in the community while integrating her banking and finance background. This is when she joined Impact Deposits Corp. and became the liaison between them and their network of banking partners. Currently, Rosy has been able to pursue her passion by utilizing her bank relationships to give back to non-profits in our community.

BOARD OF DIRECTORS

Chairman & Secretary

William R. Burdette

Read Bio

William Burdette is President of Charity Services Centers, P.A. (CSC), and CEO of Impact Deposits Corp. Bill offers over 30 years of corporate finance and investment banking experience and previously owned and managed a regional broker-dealer firm. As the founder of CSC and Impact Deposits, Bill has been instrumental in product development, patent processing, legal structuring, computer automation, and government authorization. Bill developed the “charity affinity program”, the signature program of CSC, which links community banks with local charitable organizations. CSC now serves over 200 nonprofits and has four regional offices and eight satellite locations around the country. Bill also sits on the Board of Directors of Learning 1 to 1 Foundation. Bill received a bachelor’s degree from Northwestern University, Evanston, Illinois (B.A., 1969), a law degree from Columbia Law School, and an MBA from the University of Miami.

Director

Alexandra Esher

Read Bio

Alex has over 25 years of financial management experience, including Vice President and Business Manager of a telecommunications company. Alex is President of Impact Deposits Corp. and has been with the company since 2005. She has been instrumental in catalyzing Impact Deposits’ growth through financial management and operational and administrative oversight. Alex is also the Vice President of Charity Services Centers, P.A. and responsible for managing bank relations and facilitating meaningful connections between banks and nonprofits. She advises many nonprofits on their programs and enjoys being a resource for them.

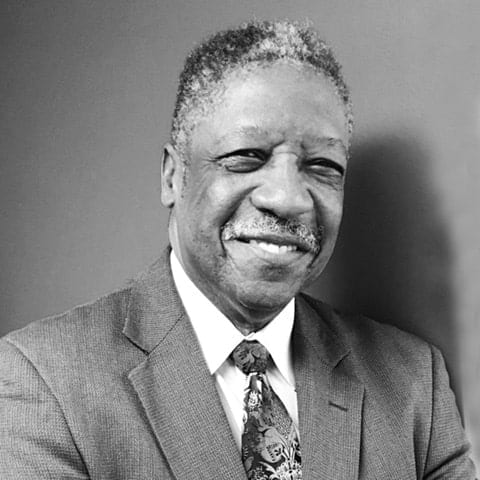

Director

Julius Jackson

Read Bio

Mr. Jackson has been President of People Helping Each Other, Inc., since May 2010. He has been the Company’s key business development person. Mr. Jackson became an activist in 1964 as a 17-year-old, marching with Dr. King in St. Augustine, Florida. As an activist with vision, Mr. Jackson has parlayed the benefits of a nonprofit enterprise with the free market philosophy of a for-profit business. His activism led to his co-founding Ryan Millennium Group Inc., in November of 2014. Ryan Millennium Group, Inc., has multi-racial ownership and was created to bring about racial harmony in North America and Africa through multiple economic strategies. The histories of Millennium Group Worldwide, Inc. and Ryan Inc. was perceived by their owners to be a perfect match for the task, and thus, Ryan Millennium Group, Inc., was formed. Most recently, Mr. Jackson encouraged a group of like-minded individuals to establish a new business, Social Investment Holdings, Inc., to capitalize on one of the newest tools for helping small businesses from the Securities and Exchange Commission, Regulation A.

AFFILIATES

A law firm that is committed to solving community social challenges by bringing banks and nonprofits together, CSC is Impact Deposits' direct financial conduit to hundreds of nonprofits and charitable causes across the U.S.

A co-working environment and national hands-on support for mission-driven leaders and organizations, C4SC is Impact Deposits' arm for providing nonprofits and social entrepreneurs a community in which to work, connect, innovate, and learn.

Offering a service that makes it easier for banks to identify and qualify nonprofits that meet banks’ specific Community Reinvestment Act (CRA) and impact criteria, findCRA is supported by Impact Deposits to foster the connection between banks and the impactful organizations in the communities they serve.