Simple

Powerful

Proven

Impact Deposit Program

0verview

Impact Deposits enables a simple yet powerful way to protect and manage large cash deposits through a single account on behalf of its clients across the U.S.

Key Benefits

- Simple online management

- FDIC-insured deposits beyond $250K individual bank limit

- Next-day liquidity

- Competitive interest rate

- Single monthly statement

- Automated trade confirmations

- No fees for account setup or transactions

ENROLLMENT IS STRAIGHTFORWARD

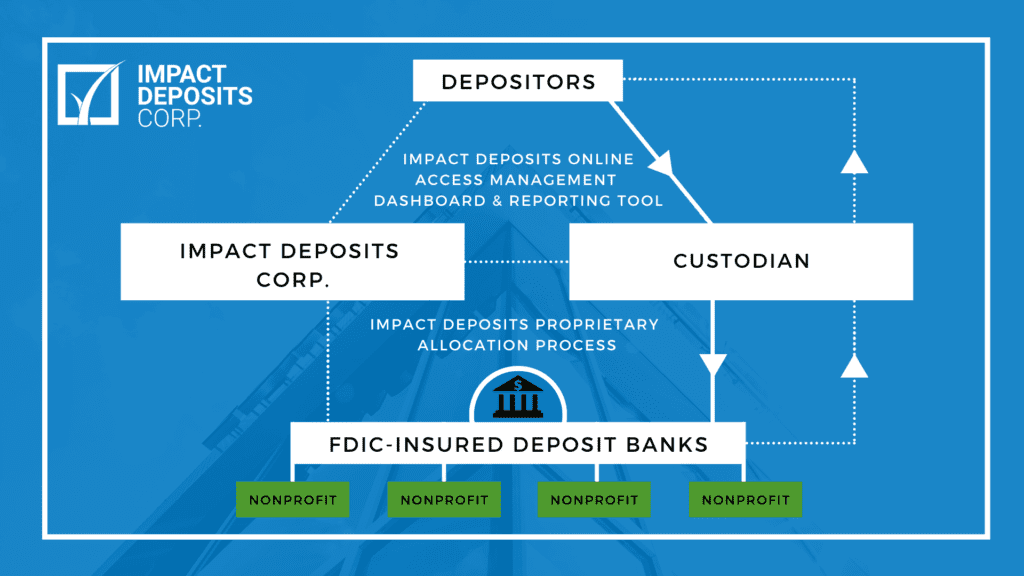

- Depositor signs agreements with both Impact Deposits Corp. and a designated custodian bank acting as a depository agent.

- Depositor funds are wired to the agent bank and directed by Impact Deposits throughout its community bank network in increments less than $250,000, which ensures FDIC insurance on all funds.

- Depositor may view their account status and interest earned as well as the location of their funds via the Impact Deposits online portal.

- A portion of the fees Impact Deposits receives for managing deposits in the program are distributed to charitable organizations that Impact Deposits and its community bank network support.

- Depositor may request the return of some or all of their funds the next business day through Impact Deposits’ online portal.

FLOW OF FUNDS

HOW THE PROGRAM

DELIVERS IMPACT

Program deposits are distributed across a network of community banks so that funds are available for lending in those communities. 2 bps of all deposits in program banks are donated (through Impact Deposits’ wholly-owned subsidiary, Charity Services Centers) to nonprofits in that community as selected by the bank, program depositors, or CSC.

Impact Deposits makes direct donations to deserving charities (including some in the nonprofit incubator it founded and supports, Center for Social Change). Impact Deposits invests in companies (e.g., findCRA) that encourage greater participation by banks in socially impactful causes in their communities.

Serving Regional Interests

For depositors with a focus on a particular geography (e.g., community foundations, municipalities, local pensions, etc.), Impact Deposits customizes its program to address regional interests. If the depositor already has a local charitable beneficiary identified, then Impact Deposits ensures that impact funds generated from those deposits are directed to that beneficiary; if not, Impact Deposits (through its wholly-owned subsidiary Charity Services Centers) identifies a local nonprofit or helps a successful program from another region expand into the area.

Additionally, if Impact Deposits currently does not have a local bank in its Community Bank Network into which some of the depositor’s funds can be placed, then Impact Deposits will work to expand its network in that region. If the depositor has a CDFI or minority depository institution (MDI) with which it prefers to work (but has deposits exceeding the $250,000 insured limit), then Impact Deposits can incorporate that CDFI or MDI into the customized program, allocating some deposits to the CDFI/MDI and spreading the remainder throughout the Community Bank Network to maintain insurance on all funds.

Interest Rates

The interest rate on the program is variable and determined by the Fed Funds Target Rate, which in turn is set by the FOMC (Federal Open Market Committee of the Federal Reserve), but Impact Deposits always pays interest on deposits even when the Fed Funds Rate is at or near 0.

Impact Deposits offers a gross rate and does not charge any fees. The entire gross rate can be passed on to the depositor, or for situations in which a depositor is represented by an advisor, the rate may be reduced by the advisor’s fee. Impact Deposits earns its income through the spread between the interest rate on deposits that the network banks pay Impact Deposits and the interest rate delivered by Impact Deposits to its depositors.

Program Details

Depositor accounts at each bank are kept below $250,000 per tax ID in order to maintain FDIC insurance on the deposits; depositors cannot lose their deposits or interest earned due to the FDIC insurance. Deposits in the network are in FDIC-insured money market accounts with next-day liquidity. Currently the program can insure up to $50 million per tax ID; additional capacity is being added.

Impact Deposits places funds only in well-capitalized banks as defined by the FDIC; funds are removed from a bank if it is no longer considered well capitalized. Over 1,000 depositors utilize the Impact Deposits’ program, including institutional investors, local governments, and private parties/organizations.

Program deposits are distributed across a network of community banks so that funds are available for lending in those communities. 2bps of all deposits in program banks are donated (through Impact Deposits’ wholly-owned subsidiary, Charity Services Centers) to nonprofits in that community as selected by the bank, program depositors, or CSC.

Impact Deposits makes direct donations to deserving charities (including some in the nonprofit incubator it founded and supports, Center for Social Change). Impact Deposits invests in companies (e.g., findCRA) that encourage greater participation by banks in socially impactful causes in their communities.

Serving Regional Interests

For depositors with a focus on a particular geography (e.g., community foundations, municipalities, local pensions, etc.) Impact Deposits customizes its program to address regional interests. If the depositor already has a local charitable beneficiary identified, then Impact Deposits ensures that impact funds generated from those deposits are directed to that beneficiary; if not, Impact Deposits (through its wholly-owned subsidiary Charity Services Centers) identifies a local nonprofit or helps a successful program from another region expand into the area.

Additionally, if Impact Deposits currently does not have a local bank in its Community Bank Network into which some of the depositor’s funds can be placed, then Impact Deposits will work to expand its network in that region. If the depositor has a CDFI with which it prefers to work (but has deposits exceeding the $250,000 insured limit), then Impact Deposits can incorporate that CDFI into the customized program, allocating some deposits to the CDFI and spreading the remainder throughout the Community Bank Network to maintain insurance on all funds.

Interest Rates

The interest rate on the program is variable and determined by the Fed Funds Target Rate, which in turn is set by the FOMC (Federal Open Market Committee of the Federal Reserve). Impact Deposits delivers an interest rate that remains stable and adjusts only when the Fed Funds Rate changes.

Impact Deposits offers a gross rate and does not charge any fees. The entire gross rate can be passed on to the depositor, or for situations in which a depositor is represented by an advisor, the rate may be reduced by the advisor’s fee. Impact Deposits earns its income through the spread between the interest rate on deposits that the network banks pay Impact Deposits and the interest rate delivered by Impact Deposits to its depositors.

Program Details

Depositor accounts at each bank are kept below $250,000 per tax ID in order to maintain FDIC insurance on the deposits. Depositors cannot lose their deposits or interest earned due to the FDIC insurance. Deposits in the network are in FDIC-insured money market accounts with next-day liquidity. Currently the program can insure up to $50 million per tax ID. Additional capacity is being added.

Impact Deposits places funds only in well-capitalized banks as defined by the FDIC. Funds are removed from a bank if it is no longer considered well capitalized. Over 1,000 depositors utilize Impact Deposits’ program, including institutional investors, local governments, and private parties/organizations.

Put Your Cash Deposits to work

Impact Deposits enables a simple yet powerful way to protect and manage large cash deposits through a single account on behalf of its clients across the U.S.