FDIC DEPOSIT INSURANCE

An Innovative Cash-Management Solution for Individual and Institutional Depositors

Now high-net-worth individuals, as well as a range of public and private institutions, can realize superior protection and competitive interest rates for large cash deposits. Funds deposited through Impact Deposits Corp.’s innovative network achieve full FDIC insurance beyond traditional $250,000 limits.

Through a single account, funds are liquid and secure, while giving depositors the access and convenience of a traditional FDIC-insured money-market account.

INSURANCE MAKES THE DIFFERENCE AND WE CAN HELP YOU WITH THAT!

Impact Deposits enables a simple yet powerful way to protect and manage large cash deposits through a single account on behalf of its clients across the U.S.

Deposit insurance is one of the significant benefits of having an account at an FDIC-insured bank—it’s how the FDIC protects your money in the unlikely event of a bank failure

The standard insurance amount is

$ 250,000

per depositor, per insured bank, for each account ownership category*

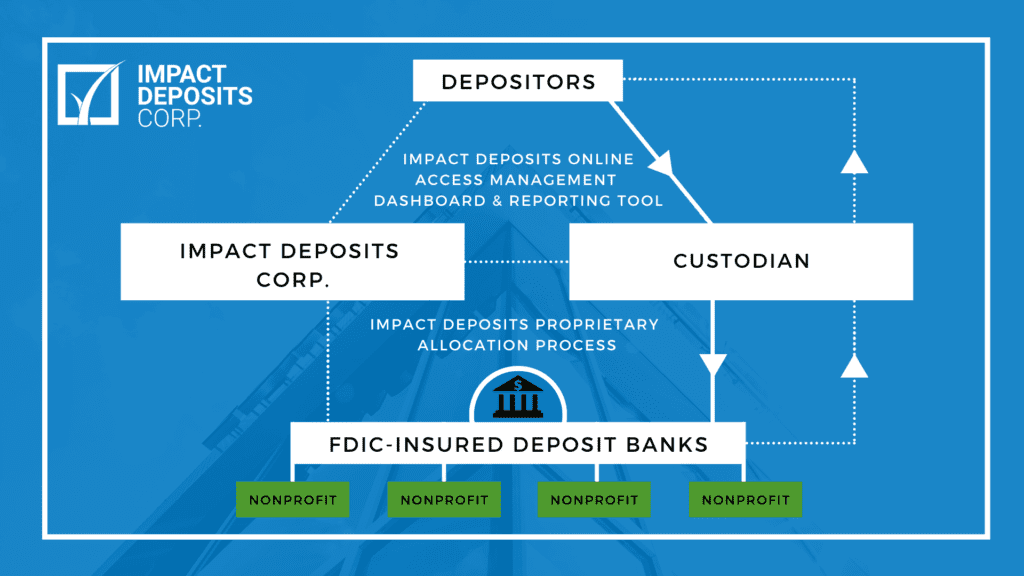

SIMPLE PROVEN POWERFUL: HOW DOES IT WORK?

- – Simple online management

- – FDIC-insured deposits beyond $250K individual bank limit

- – Next-day liquidity

- – Competitive interest rate

- – Single monthly statement

- – Automated trade confirmations

- – No fees for account setup or transactions

SECURE AND SOCIALLY IMPACTFUL:

HOW OUR PROGRAM

DELIVERS IMPACT

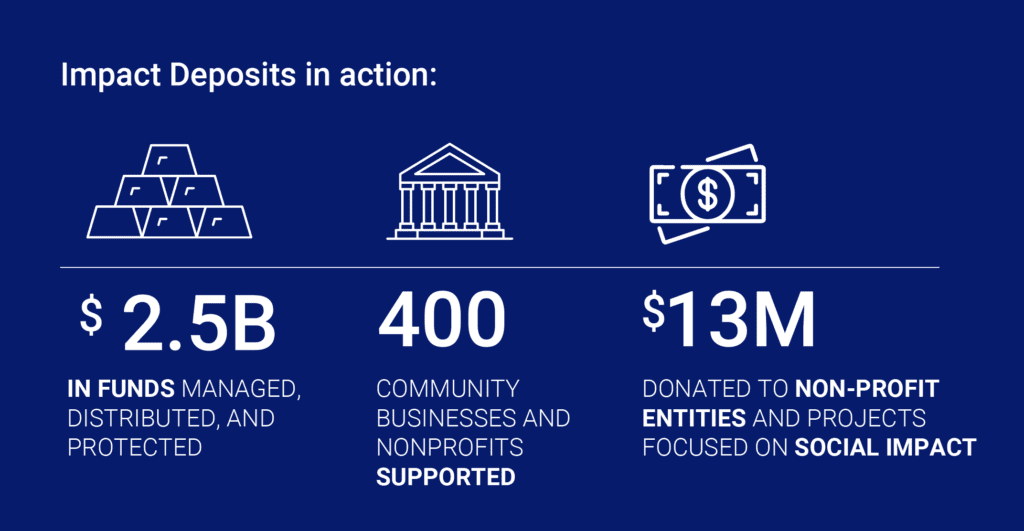

Program deposits are distributed across a network of community banks so that funds are available for lending in those communities. 2 bps of all deposits in program banks are donated (through Impact Deposits’ wholly-owned subsidiary, Charity Services Centers) to nonprofits in that community as selected by the bank, program depositors, or CSC.

Impact Deposits makes direct donations to deserving charities (including some in the nonprofit incubator it founded and supports, Center for Social Change).

Impact Deposits invests in companies (e.g., findCRA) that encourage greater participation by banks in socially impactful causes in their communities.

Across the globe, the creation of social capital is now a priority.

The simple decision of where you deposit your cash can be used to make a better future.

WE’D LOVE TO HEAR FROM YOU

The advantages of Impact Deposits Corp. solutions can help you better-manage large cash deposits in meaningful ways. For more information about how to invest, please contact us at [email protected] .